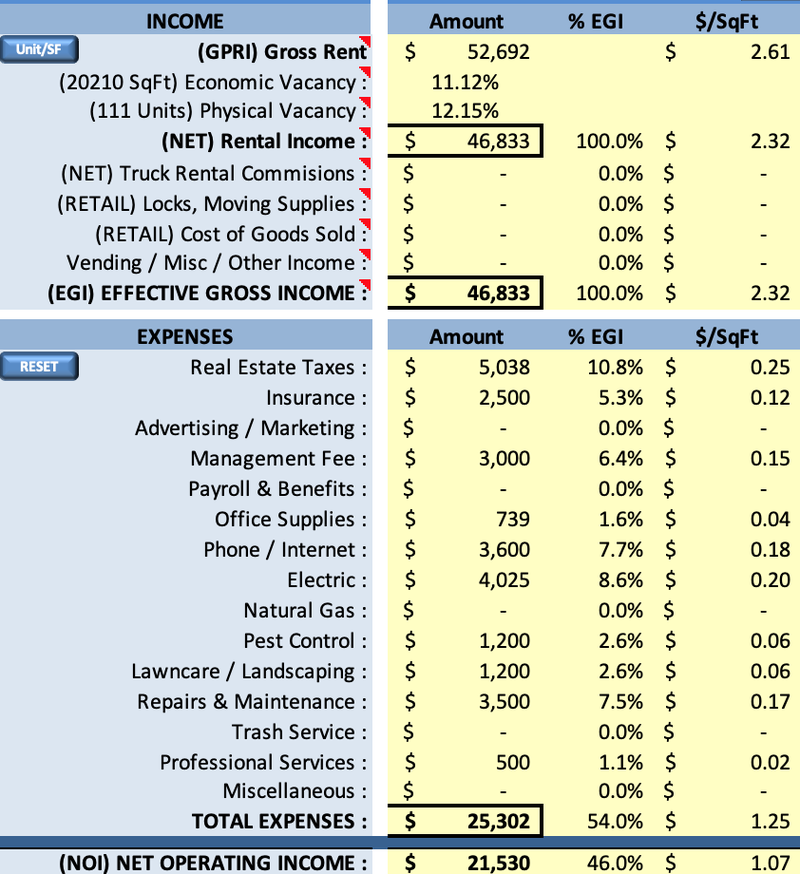

If the NOI falls below a certain level, you may have to sell the property. When deciding whether to lend you money to purchase or make improvements to the building, lenders may look at the NOI. The figure does not include non-operating expenses such as business income taxes, loan payments, or capital expenditures. NOI can also be referred to as EBIT – earnings before interest and taxes – which is a profit-making measure. When a property generates revenue, its net operating income (NOI) is calculated, indicating the value of the property to commercial real estate owners and investors. Other important factors include the property’s location, its age and condition, and the local market conditions. When evaluating a property’s NOI, investors should keep in mind that it is only one factor to consider. It also allows investors to compare properties on a level playing field. The NOI is a valuable metric for investors because it provides a clear picture of a property’s profitability. The NOI is calculated by subtracting the property’s operating expenses from its gross income.

Its operating expenses include property taxes, insurance, utilities, and repairs and maintenance. A property’s gross income is its total revenue from all sources, including rent, retail sales, and parking fees. The NOI is a key metric used by investors to assess a property’s profitability and potential for future growth. The net operating income (NOI) of a commercial property is the difference between the property’s gross income and its operating expenses.

0 kommentar(er)

0 kommentar(er)